Switzerland’s tax system can be complicated, especially for expatriates who have just arrived in the country.

Being privy to tax responsibilities is essential to ensure compliance and avoid surprising consequences.

Expats in Switzerland regularly face challenges including language barriers and being aware of the nuances of local taxation.

When you’ve got full recognition of the Swiss tax device, expats can control their monetary duties and make informed decisions.

Let us talk about it.

Overview of the Swiss Tax System

The Swiss tax machine’s shape is a bit complex, operating on three independent levels, federal, cantonal, and municipal, resulting in regional variations throughout the country:

Federal Level:

- Income tax is modern, with higher earners paying better rates.

- This country-wide trend sets a baseline of taxation throughout Switzerland.

Cantonal Level:

- Each canton determines its tax quotes, mainly due to differences in tax liabilities from one canton to another.

- These rates can considerably affect how a great deal citizens owe, depending on where they stay.

- Cantonal governments also have the authority to set regulations for positive deductions and allowances, including the regional versions.

Municipal Level:

- Municipalities can impose additional nearby taxes, further influencing the overall tax burden.

- Municipal tax costs are often a percentage of the cantonal tax, adding every other layer of variability.

- It is a level that lets in local government accumulate funds for network services and infrastructure.

Various kinds of profits are a concern to taxation, which means that expats need to be aware of how their income is categorized:

- Business income

- Employment income

- Pensions

- Rental income

- Investment profits and other profits

The taxation procedure follows a pay-as-you-earn (PAYE) model:

- Employers deduct taxes immediately from salaries, simplifying tax compliance for most employees.

- For those with extra profits or particular instances, submitting an annual tax return is important to report greater earnings, declare deductions, or declare allowances.

If you need some help understanding these basic factors, visit SimpleTax.

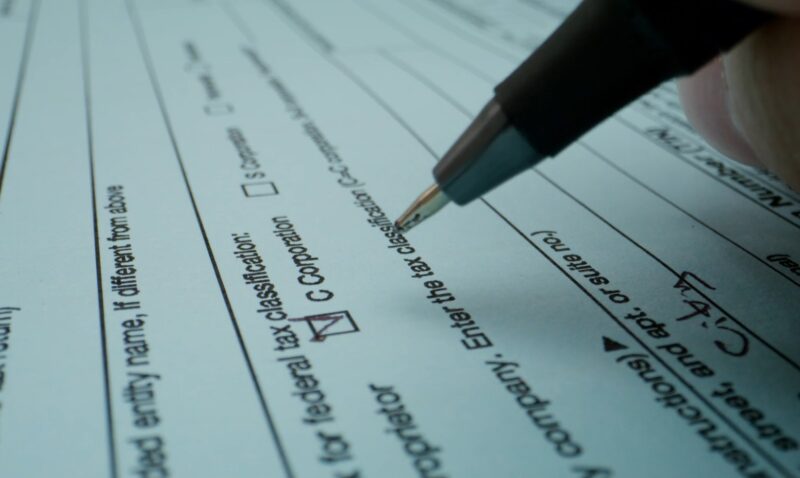

Who Needs to File a Tax Return?

Tax submitting necessities in Switzerland vary primarily based on elements which include residency popularity, earnings level, and the sort of income earned.

Below are the general pointers:

- Swiss Citizens and Permanent Residents

- All Swiss residents and permanent residents (Permit C holders) need to record annual tax returns, regardless of earnings degree.

Expats on Ordinary Tax Assessment

For expatriates, tax submitting will become mandatory if they have a problem to normal tax evaluation.

The evaluation applies whilst annual income exceeds:

- CHF 120,000 for most regions.

- CHF 500,000 specially in Geneva.

Expats with additional earnings assets, along with investment income, apartment belongings earnings, or giant property, are also required to file a tax return.

Cases Where Withholding Tax Is Applied

In sure conditions, the profits tax is withheld directly at the source, typically with the aid of employers. The gadget often applies to non-citizens, simplifying the tax procedure.

Withholding tax eliminates the want for a separate tax to go back if the earnings are fully taxed at the source.

However, people may nevertheless need to file if they:

- Earn above a positive threshold.

- Have more than one profits resources that require additional reporting.

- Seek to assert deductions or refunds not accounted for through withholding tax.

These situations emphasize the significance of know-how individual tax obligations, especially for expats who can also face more complicated conditions based on income stages and assets.

Special Considerations for Expats

The Swiss tax system has particular rules tailored for non-residents, making it critical for expats to be aware of their tax status.

Taxation at Source

Non-residents, who do now not preserve everlasting residency (including Permit C), generally have their earnings taxed at once at the source.

Employers deduct taxes from salaries earlier than price, simplifying the technique for non-resident employees.

Income Exemptions

Some types of profit, like lottery winnings and reimbursement for damages, aren’t taxed, imparting relief in precise situations.

Expats have to be privy to these exemptions and the way they apply to their economic situation.

Double Taxation Agreements (DTAs)

Switzerland has mounted numerous DTAs with different nations to prevent double taxation on the same income.

These agreements are especially beneficial for expats who earn income in a couple of nations, ensuring they aren’t taxed twice.

When Expats Need to File a Tax Return

Even with taxes deducted at source, some expats might still need to file a return.

Expats married to Swiss nationals or those with good-sized assets might be required to claim their profits and property.

How to File Your Tax Return

Filing a tax go back in Switzerland may be attainable in case you prepare nicely. Follow these steps to ensure a smooth technique:

Gather Required Documents:

- Income statements from employers

- Pension certificate

- Investment information

- Receipts and facts for deductible charges

- Educational

- Commuting

- Business-related charges

- Additional documents may be needed for self-employed individuals

To start, make certain you’ve got all the vital office work reachable. Proper documentation is important for correctly reporting your earnings and claiming deductions.

Depending on the situation, you may want to offer more documentation, mainly in case your income comes from self-employment or a couple of assets.

Choose Filing Method:

- Digital submitting (via online systems or software)

- Paper submitting (traditional bureaucracy submitted with the aid of mail)

You can document your tax return digitally or on paper. Digital submitting is commonly desired because it accelerates the procedure, providing immediate feedback on errors or lacking records.

Deadlines and Local Regulations

Swiss tax regulations range by canton, which means closing dates and policies may differ based on in which you live.

It’s critical to be aware of your neighborhood requirements and ensure your tax return is submitted on time. Missing the deadline may result in consequences or hobby prices.

Self-Employment Considerations:

- Register for tax functions in case you are self-employed

- Provide information about your commercial enterprise and projected profits

For folks who are self-employed, an additional step entails registering for tax functions.

Unlike conventional personnel, self-hired people must make sure their business profits are suggested separately because it is not taxed on the supply.

Tax Deductions and Relief

@annyamnurse Taxes and Deductions in Switzerland. How much i pay #expatsinswitzerland #pinayinswitzerland🇨🇭 #movetoswitzerland #taxswitzerland #quellensteuerschwei #filipinonurseinswitzerland ♬ original sound – AnnYam

Swiss tax regulations allow for numerous deductions, which may be especially beneficial for expatriates.

Common deductions consist of:

- Business costs

- Commuting costs

- Educational expenses

- Daycare prices

These deductions can appreciably decrease your taxable earnings, leading to potential financial savings.

Expats on brief assignments may also qualify for unique deductions, which include the ones associated with:

- Relocation

- Housing

- Commuting between nations

To optimize your tax return, it’s miles critical to hold specified statistics of deductible costs.

Taking advantage of available deductions requires cautious planning, especially if your tax situation entails a couple of assets of earnings or move-border assets.

Consulting a tax professional can help perceive additional relief options and ensure compliance with nearby laws.

Consequences of Non-Compliance

Failing to conform to tax duties in Switzerland can lead to severe outcomes.

Penalties for late filing or non-payment are steep and might encompass:

- Fines

- Interest on late taxes

- Legal action in intense cases

To keep away from these issues, it is essential to understand submitting deadlines and necessities.

If you discover you are not able to fulfill the filing deadline, you can request an extension. Extensions ought to be submitted before the deadline, and approval isn’t guaranteed, so planning is crucial.

In instances in which there is a dispute over tax exams, there is an option to enchantment, however, this manner requires clear evidence and documentation to assist your claim.

For expatriates dealing with language barriers or complicated monetary conditions, looking for expert advice is strongly endorsed, as it could assist save you highly-priced mistakes and make sure that each one obligations are met nicely.

The Bottom Line

Learning about the Swiss tax device as an expat can be hard, however information the key factors and requirements can make it possible.

Staying knowledgeable and proactive approximately your tax duties will assist you keep away from needless complications.

If wished, are trying to find expert assistance to make certain compliance and optimize your tax return.

Hello, my name is James Willett. I am a marketing veteran, with decades of experience under my belt. At one point, I decided to share my experience with others, especially those who are making baby steps in marketing. Therefore, I decided to join fine folks at PulseBluePrint.com where I share my insights on all sorts of marketing. I hope you will find my insights useful.