An insurance binder is a necessary document for homeowners during the mortgage process. It serves as proof that the property has insurance coverage, ensuring it is protected while the complete insurance policy is prepared. Lenders require this document as part of the closing process, making it essential for avoiding delays.

The insurance binder confirms the terms of coverage, including policy limits and the effective date. This document ensures all involved parties, including the lender and the buyer, have the necessary information to proceed confidently. Without it, the mortgage process could stall, creating unnecessary stress for the buyer.

This guide explains everything about insurance binders, their purpose, and their role in helping homeowners meet lender requirements while securing their home investment.

What Is Included in the Binder?

An insurance binder includes key details that confirm temporary coverage for the property while the official policy is finalized. Each element in the binder serves a specific purpose, ensuring that both the homeowner and lender have the necessary information to proceed with the mortgage process smoothly.

1. Names of the Insured Parties

The binder lists the primary policyholder and any additional insured parties. For homeowners, this often includes the property buyer and co-borrowers, ensuring all relevant individuals are covered under the terms of the policy.

2. Description of the Insured Property

The document provides a detailed description of the property being insured. This may include the address, type of dwelling, and any notable features that impact the insurance coverage. Lenders require this to verify that the binder matches the specific property tied to the mortgage.

3. Policy Coverage Types

The binder outlines the types of coverage included, such as property coverage, liability protection, or additional options like coverage for natural disasters. This ensures the homeowner understands what risks are temporarily insured until the full policy is issued.

4. Coverage Limits and Deductibles

It specifies the maximum amounts the insurance company will pay for claims under each coverage type, along with the deductibles the insured must pay before coverage applies. This clarity helps both the homeowner and lender assess whether the coverage meets their needs and any lender requirements.

5. Lender Information

The binder includes the name and address of the mortgage lender as an interested party. This ensures the lender will be notified of any changes or lapses in coverage during the binder period. It also protects the lender’s interest in the property.

6. Effective Dates of the Binder

The document clearly states the start and expiration dates of the binder. This temporary coverage typically lasts 30 to 60 days, providing protection during the transitional period until the official policy is active. Accurate dates prevent gaps in coverage that could delay the mortgage process.

7. Premium Amount Paid

The binder confirms the premium amount paid for the temporary coverage. Proof of payment reassures the lender that coverage is active and eliminates any questions about whether the property is insured during the critical stages of the mortgage process.

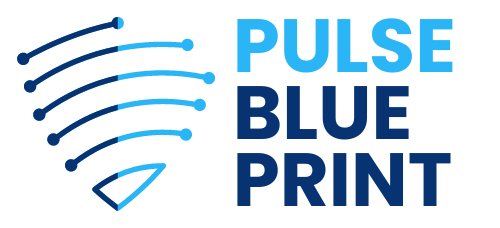

How Is Binder Different from the Full Policy?

- Temporary in nature: It is only valid for a limited period, often 30 to 90 days.

- Not as detailed: While it contains the key points, it does not include the full terms and conditions of the policy.

- Transition document: It bridges the gap between the time coverage begins and when the full policy is issued.

They offer solutions for homeowners insurance, private health plans, and business coverage.

What Information Does Binder Contain?

An insurance binder contains specific details that serve as temporary proof of insurance coverage. Each item included ensures the binder is clear and fulfills both the homeowner’s and the lender’s requirements.

1. Insured Party Information

It includes the full name(s) of the individuals covered by the insurance policy. This often includes the property buyer and anyone else who will hold ownership or legal responsibility for the property.

2. Insured Property Details

The document specifies the address of the insured property. If applicable, it may also include descriptions of the property’s type, structure, or any key features that impact the terms of the coverage.

3. Coverage Specifics

The binder outlines the types of coverage included, such as protection for property damage, liability coverage, or specialized add-ons like flood or earthquake insurance. This ensures the lender knows the home has sufficient coverage to meet their requirements.

4. Policy Limits

This section explains the maximum amount the insurer will pay for a covered claim. The limits vary based on the type of coverage, ensuring clarity on the level of protection provided during the binder period.

5. Deductibles

It clearly states the deductible amounts, which are the portions the homeowner must pay before insurance coverage applies. Knowing this information helps the homeowner understand their financial responsibilities if a claim arises.

6. Premium Confirmation

It provides proof that the premium has been paid or an agreement is in place for payment. This assures the lender that the policy is active and the property is insured during the transition period.

7. Effective Dates

The temporary coverage typically lasts between 30 and 60 days, bridging the gap until the full policy is in effect. Exact dates are critical to prevent any lapse in coverage.

Here is an example of all the data combined.

| Section | Details |

|---|---|

| Insured Party | John Doe, Jane Doe |

| Insured Property | Address: 123 Main Street, City, State, ZIP |

| Property Type: Single-family home | |

| Year Built: 2000 | |

| Coverage Types | Property Coverage: Protection for the home structure |

| Liability Coverage: Legal and medical expenses for third-party injuries | |

| Additional Coverage: Windstorm and hail protection | |

| Policy Limits | Property Damage: $250,000 |

| Liability: $100,000 | |

| Deductibles | Property Damage: $1,000 |

| Windstorm and Hail: $2,000 | |

| Premium Confirmation | Annual Premium: $1,500 |

| Paid: $100 upfront for the binder period | |

| Effective Dates | Start Date: November 1, 2024 |

| Expiration Date: December 1, 2024 | |

| Lender Information | Lender Name: ABC Mortgage Corp |

| Lender Address: 456 Elm Street, City, State, ZIP |

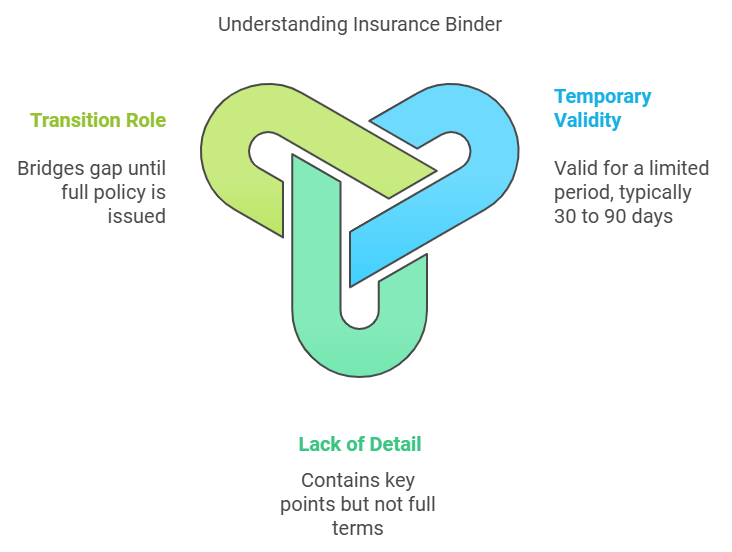

Why Is It Important for Homebuyers?

It ensures that lenders and homeowners are protected from potential risks during the time between securing insurance and receiving the full policy.

Why Lenders Require It

Lenders require an insurance binder for several reasons that revolve around protecting their financial investment. These include:

- Proof of Coverage: Lenders want to confirm that the property is insured before closing the mortgage. The binder serves as official documentation showing that temporary coverage is in place.

- Minimizing Financial Risk: The binder ensures that the lender will not face financial loss if the property is damaged or destroyed during the time between the loan approval and the issuance of the final policy. This is particularly important because the property serves as collateral for the loan.

- Loan Compliance: Mortgage agreements typically require that the borrower maintain continuous and adequate insurance coverage on the property. The binder ensures compliance with these terms, allowing the lender to proceed confidently with closing.

Benefits for Homebuyers

The binder is just as important for homebuyers as it is for lenders. It provides:

Peace of Mind

Homebuyers can rest easy knowing their new investment is temporarily insured against risks like damage, accidents, or natural disasters.

Protection Against the Unexpected

Unforeseen events such as a fire, storm, or burglary could occur at any time. Having a binder ensures that the property is protected during the transitional period when risks are still present.

Avoiding Closing Delays

A missing binder can delay the closing process, causing stress and potentially leading to financial penalties or the loss of the property deal. Ensuring the binder is in place eliminates this risk and keeps the process on track.

When You Might Need One?

A binder is not only useful when purchasing a home.

Common Situations That Require This Document

- Buying a new home: Lenders need confirmation of insurance before approving the loan.

- Refinancing a mortgage: A new lender requires updated proof of insurance for the refinanced loan.

- Renewing a policy: When transitioning between policies, a binder provides continuity of coverage.

How to Obtain it?

Steps to Get a Binder

- Contact your broker or agent.

- Provide the required details about the property and coverage.

- Pay the premium, if applicable, to activate the binder.

- Confirm that the insurer sends the document to your lender and provides you with a copy.

What Happens When the Document Expires?

An insurance binder has a temporary nature, with a validity period usually lasting between 30 and 90 days. It is designed to provide short-term coverage while the insurance company processes and finalizes the full policy.

Once the binder expires, it should be replaced seamlessly by the finalized policy to ensure uninterrupted protection. If the official policy is not in place by the expiration date, serious coverage gaps can arise, leaving both the homeowner and lender vulnerable to risks.

Transition to the Full Policy

The expiration of the binder activates the transition to the finalized insurance policy.

- Policy Finalization

Before the binder expires, the insurer completes the underwriting process, confirming the terms and conditions of the coverage. This includes verifying details about the property, assessing risk factors, and determining premium rates. - Issuance of the Full Policy

The insurance company provides the homeowner with the full policy document, which contains comprehensive details, including coverage limits, terms, exclusions, and other conditions. A key component of this document is the declaration page, summarizing the coverage and confirming the policy is active. - Lender Notification

Once the full policy is issued, the insurer forwards the updated coverage details to the lender. This ensures the lender has proof that continuous insurance protection is in place, meeting the requirements of the mortgage agreement.

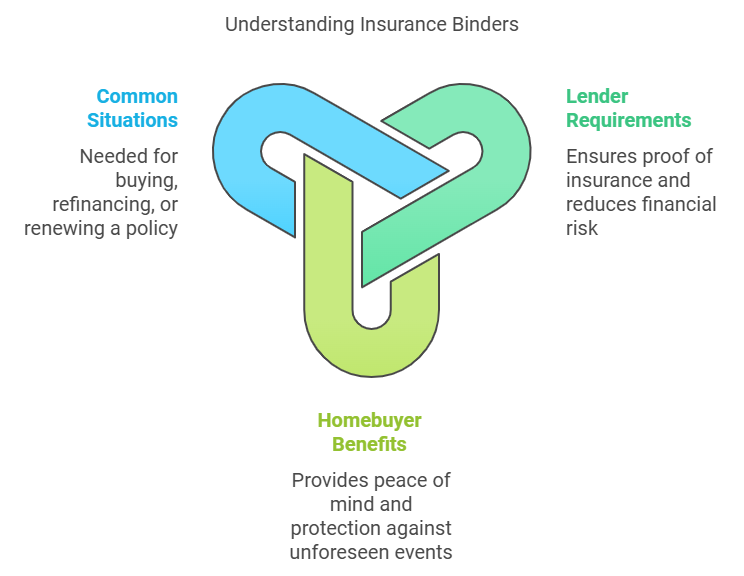

Risks of Not Having a Binder

Consequences for Homebuyers

Homebuyers face significant risks if they do not provide an insurance binder on time/

Delayed or Canceled Closings

Lenders require proof of insurance to approve and finalize a mortgage. Without a binder, the closing process can be delayed, potentially jeopardizing the entire home purchase. In competitive markets, this could mean losing the property to another buyer.

Higher Costs for Last-Minute Coverage

If a binder is not secured in advance, buyers may have to rush to obtain insurance at the last moment. That can lead to higher premiums, limited coverage options, or even penalties for failing to meet deadlines.

Liability for Property Damage

If the property sustains damage, such as from a fire or storm, before the full policy is issued, the buyer could be held financially responsible.

Impact on Lenders

Lenders also face considerable risks if a binder is not provided.

Exposure to Financial Loss

Without proof of insurance, the lender risks losing their investment in the property if damage occurs before coverage is established.

Loan Processing Delays

The absence of a binder can stall loan approvals or require adjustments to the loan agreement, creating administrative headaches for both the lender and the buyer. That can also increase the overall cost of the transaction or delay access to funding.

How an Insurance Binder Protects Both Parties

Protection for Homeowners

The binder guarantees that temporary coverage is in place. If damage occurs, such as a fire, storm, or theft, homeowners are financially protected, even before the final insurance policy is active.

Purchasing a home is a significant financial commitment. The binder ensures that the property is insured during the final steps of the transaction, safeguarding the buyer’s investment from unforeseen risks.

Protection for Lenders

The binder confirms that the property is insured for risks like fire, theft, or natural disasters.

If an uninsured event damages the property before the mortgage is finalized, the lender could face financial losses.

Loan agreements often mandate that the borrower maintain insurance on the property. The binder serves as proof of compliance, allowing the transaction to proceed without delays or complications.

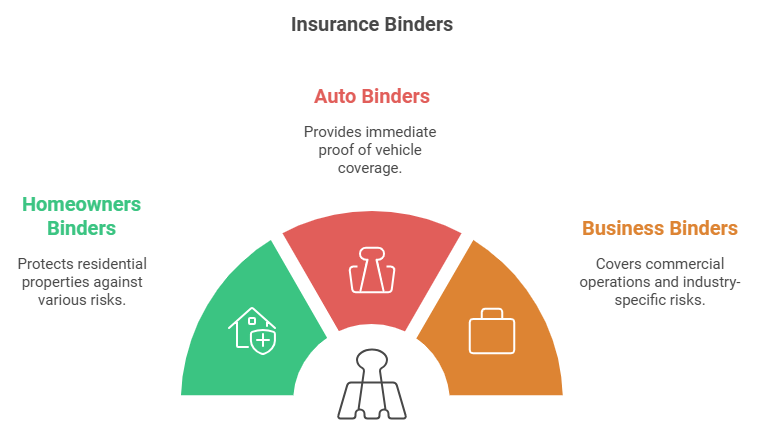

It Can Be Different Depending on Type of Policy

Homeowners Binders

- Purpose: Protects against risks like fire, theft, or natural disasters for residential properties.

- Details Included: Insured property address, coverage for the dwelling and liability, lender information, and effective dates.

Most mortgage lenders require a homeowners insurance binder before closing to safeguard their financial interest in the property.

Auto Binders

- Purpose: Provides immediate proof of coverage for a vehicle before the full policy is issued.

- Details Included: Vehicle identification number (VIN), coverage for collision, liability, and comprehensive risks, and policyholder details.

Often required when purchasing a new car or renewing a policy to meet state registration requirements or dealership demands.

Business Binders

- Purpose: Covers risks related to commercial operations, including property damage, liability claims, and employee injuries.

- Details Included: Business name, covered property or assets, liability limits, and specific endorsements for industry-related risks.

Some industries, like construction or healthcare, may require additional coverage types such as workers’ compensation or professional liability, which would be noted in the binder.

FAQs

Last Words

By understanding its importance, knowing when it is needed, and managing it effectively, you can avoid delays and ensure your investment is secure.

Always work closely with your insurer or agent to ensure your binder is accurate, timely, and aligned with your coverage needs.

Hey there! I’m Isla Craig. I’ve spent years diving into the ins and outs of the modern workplace, helping people get ahead and feel good about their careers. From boosting productivity to nailing leadership skills and personal growth, I’ve got a bit of experience in it all.

On our website, my mission is simple: give you the tools and tips you need to rock your career and enjoy a balanced life. I’m here to be your go-to source for advice and inspiration, no matter where you are in your professional journey.