Cash is the oxygen of any small company. It funds payroll, keeps suppliers paid, fuels marketing tests, and cushions the slow seasons. When cash flow tightens, stress climbs, and decision-making becomes reactive.

But when you have the right tools, cash stops being a mystery. You see what’s coming, what’s owed, and where every dollar is going before it leaves your account.

The goal is to see cash earlier, hold onto it longer, and forecast where it will be weeks ahead, not guess.

Here’s a detailed, tool-by-tool guide to modern cash flow management. Each category focuses on one thing: control. Control of timing, visibility, and execution.

What Good Cash Flow Management Looks Like

A healthy cash flow system has five traits:

- Unified visibility: Every receivable, payable, and bank feed in one daily view.

- Short cash conversion cycles: Faster collections and disciplined disbursements.

- Rolling forecasts: A 13-week cash projection that updates automatically.

- Automation: Fewer manual steps across AR, AP, and expenses.

- Protection: Fraud and failed payment defenses that plug hidden leaks.

A small company that nails those five tends to feel lighter operationally. Bills no longer surprise, and slow months become survivable instead of existential.

Why Cash Discipline Matters More Than Ever

Many small businesses entered 2025 with thinner margins. The Federal Reserve’s Small Business Credit Survey reported rising financing friction and slower revenue growth across sectors.

PwC’s working capital index shows stabilization overall, but still billions of dollars locked up in receivables and inventory. Cash discipline is a survival strategy.

For companies aiming to strengthen governance and financial oversight, partnering with Ned Capital Recruitment can help attract Non-Executive Directors who bring the strategic clarity needed to keep cash decisions disciplined and board-approved.

The Core Stack

Strong cash control starts with the right accounting base. Modern platforms now include built-in cash flow views, forecasts, and bank syncs that give owners a clear, daily picture of where money stands.

QuickBooks Online

QuickBooks remains the financial backbone for many small firms. It’s where invoicing, payroll, and bank feeds converge, which makes it ideal for building real-time cash insight.

Features That Help

- Cash Flow Planner projects inflows and outflows from transaction history.

- Cash Flow Center centralizes forecasting and payment tracking.

Tips

- Reconcile weekly so the planner stays trustworthy.

- If you use multiple currencies, review feature limits before relying on forecasts.

Best for

Small teams already managing books inside QuickBooks who want a native forecast view without new software.

Xero

Xero turns short-term forecasts into visuals that owners can interpret instantly.

Key Features

- Short-term Cash Flow for real-time inflow/outflow views.

- Business Snapshot to summarize key financial health metrics.

Tips

Enable Analytics, connect every bank account, and record expected payment dates on overdue invoices for better accuracy.

Best for

Small companies that prefer clean visuals and plug-in forecasting through the Xero app marketplace.

Get Paid Sooner

Cash flow strengthens when payments arrive fast and predictably. The right invoicing and collection tools automate reminders, cut failed payments, and help you stay liquid without constant follow-ups.

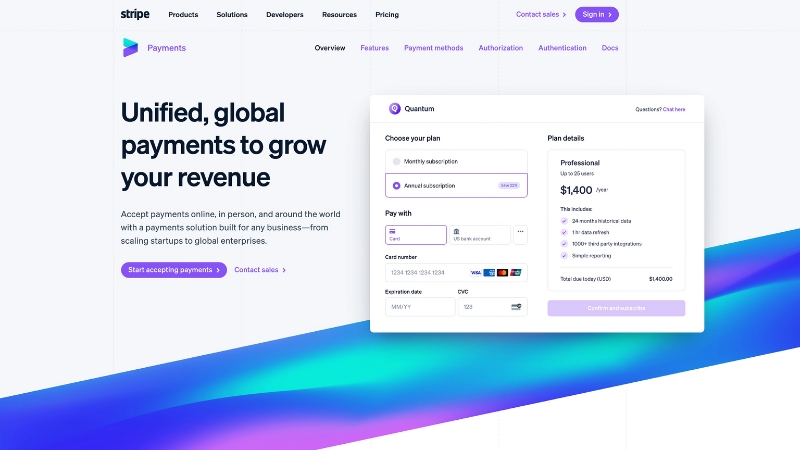

Stripe Invoicing and Billing

Stripe automates reminders and retries failed cards with “Smart Retries.” It recognizes the best times to charge again, cutting failed payments significantly.

Why It Helps Cash Flow

- Reduces collection time without human follow-up.

- Keeps revenue recognition accurate so forecasts stay aligned.

Best for

Subscription-based businesses and SaaS companies with card-on-file billing.

Square Invoices and Square Banking

Square simplifies both invoicing and access to funds. You can trigger automatic reminders, recurring invoices, and same-day transfers.

Perks

- Instant or next-day deposits with transparent fees.

- Linked checking and savings through Square Banking that align with your daily sales.

Best for

Local merchants, contractors, and service providers are already using Square POS.

PayPal Invoicing

View this post on Instagram

Send unlimited invoices at no monthly cost. You only pay when customers pay online, making it a flexible option for freelancers and online sellers.

Best for

Companies whose clients prefer PayPal or Venmo, especially cross-border ones.

GoCardless

Pulls payments directly from customers’ bank accounts via ACH or local equivalents. Reduces late payments because funds are automatically withdrawn on due dates.

Why It Helps

Low failure rates and automatic retries make recurring revenue smoother.

Best for

Agencies, gyms, and professional service providers bill on a schedule.

Chaser

Automates AR follow-ups through personalized reminders. Some users report payments arriving two weeks faster.

Best for

Businesses with heavy invoice volume and limited time to chase customers.

Pay Deliberately

The right tools let you time vendor payments precisely, automate approvals, and avoid late fees, all while keeping cash in your hands longer.

BILL (formerly Bill.com)

Centralizes payables and receivables into one digital workflow. You can schedule vendor payments, automate approvals, and sync directly with your accounting ledger.

Why It Matters

Tightens timing control and reduces late fees without manual intervention.

Best for

Companies that need both AP and AR management in a single system.

Melio

Let’s you pay vendors by credit card, even if they only accept checks or ACH. That effectively extends your float until the next card cycle.

Why It Matters

Flexibility during tight months. Same-day ACH is available for urgent payments.

Fees

2.9% for card-funded vendor payments. Free for standard ACH.

Best for

Small businesses with seasonal cash gaps or irregular vendor terms.

Wise Business

Getting paid globally doesn’t have to be complicated.

With your Wise Business account, share global account details and receive Swift payments in 23+ currencies, making international business even easier 🌍 pic.twitter.com/dtQQQDASvX

— Wise Business (@WiseBusiness_) October 7, 2024

Makes international payments at mid-market rates with no hidden markups. You can hold and send funds in multiple currencies.

Why It Matters

Cuts FX losses and simplifies global operations.

Best for

Companies paying overseas contractors or suppliers.

Control Spending

Modern expense platforms give small teams sharper control over how money leaves the business.

They automate policy enforcement, track every purchase in real time, and reveal waste before it grows into a problem.

Ramp

Automates expense policies and creates virtual cards with custom limits. Every purchase syncs with your accounting system in real time.

Why It Helps

Prevents overspending and improves timing on cash outflows.

Best for

Growth-stage businesses need clean spend control and audit trails.

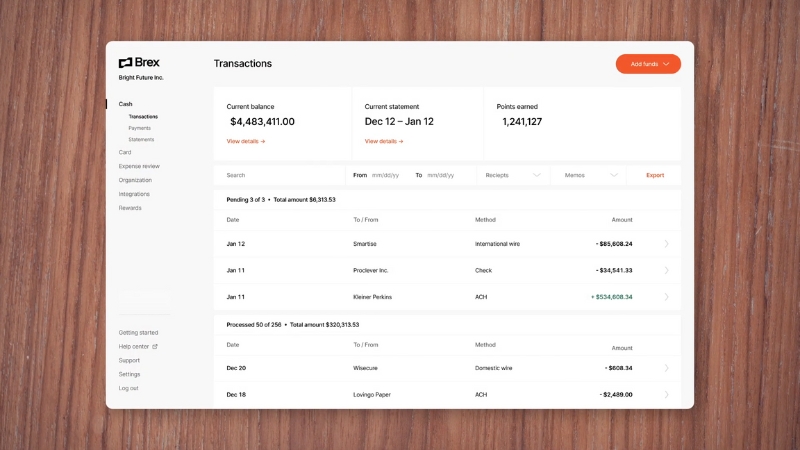

Brex

Combines corporate cards, reimbursements, and treasury tools under one platform. Offers same-hour liquidity when funds move between accounts.

Best for

Startups and venture-backed SMBs managing complex entities or global teams.

Pleo

Smart corporate cards that link to expense approvals and real-time budgets.

Why It Matters

Keeps small teams accountable and gives finance instant visibility.

Best for

European companies or distributed teams need lightweight controls.

Free Up Working Capital

Inventory ties up cash. The longer items sit unsold, the more liquidity stays locked. Smarter planning tools can return that cash to your account.

Cin7 and Cin7 Core

Connects sales, purchasing, and inventory data across multiple channels. Reduces overstocking and prevents costly stockouts.

Why It Matters

Every avoided overbuy puts cash back in circulation.

Best for

Product-based SMBs with eCommerce and wholesale operations.

Katana

Tracks raw materials, work-in-progress, and demand forecasts in one dashboard. Integrates tightly with QuickBooks.

Best for

Manufacturers and D2C brands balancing production against demand.

Shopify Tools for Retailers

Cash flow templates, educational resources, and access to Shopify Capital, a funding option tied directly to store sales.

Caution

Treat merchant cash advances as short-term bridges, not financing for long-term growth.

FP&A for Small Businesses

When your accounting tool feels too shallow, dedicated FP&A platforms add real modeling power.

| Tool | Key Capability | Best Use Case |

| Fathom | Three-way forecasting (P&L, balance sheet, cash) | Scenario planning from live QuickBooks/Xero data |

| Jirav | Driver-based models and real-time cash runway | Businesses planning headcount or pricing scenarios |

| LivePlan | Visual reporting and forecast templates | Teams building multiple cash flow scenarios |

When to Upgrade

- You manage inventory or recurring revenue.

- You need forecasts beyond 90 days.

- You report to investors or a board.

How to Choose the Right Mix

Choosing the right mix of tools starts with clarity on where your cash gets stuck. Map the friction points first, then layer software that fixes them without overcomplicating your workflow.

Start with the Job, Not the Brand

Map your weak spots before chasing software logos. Use this quick guide:

| Pain Point | Tool Category | Look For |

| Late-paying customers | AR automation | Auto reminders, bank debits, retry logic |

| Time wasted chasing bills | AP automation | Scheduled payments, approval routing |

| Sudden cash dips | Forecasting | Rolling models and scenario planning |

| Unchecked expenses | Expense management | Real-time limits, receipt capture |

| Costly FX | Cross-border payments | Mid-market rates, batch payments |

| Overstocked shelves | Inventory systems | Demand planning, channel sync |

Integrate Everything

Always pick tools that sync with your accounting system. Every manual spreadsheet adds error and delay.

Keep Fees in the Forecast

Faster cash costs money. Square, Stripe, and PayPal all post transparent fee schedules. Add those costs into your forecast so “speed” doesn’t quietly erode margins.

30-Day Practical Playbook to Tighten Cash Flow

Here’s a four-week action plan to bring cash flow under control fast, using the tools you already have and habits you can maintain long term.

Week 1 – Baseline & Quick Wins

- Turn on invoice reminders and automatic retries for failed payments.

- Centralize all receivables in Chaser or your invoicing tool.

- Enable cash dashboards in QuickBooks or Xero.

Week 2 – Control Outflows

- Route bills through BILL or Melio. Schedule payments for supplier due dates, not earlier.

- Use Melio card payments if you need a short-term float.

- Create virtual cards in Ramp, Brex, or Pleo with category limits.

Week 3 – Speed Collections

- Offer ACH debits through GoCardless to lower failure rates.

- For project-based work, use milestone billing in Stripe or Square to get partial payments earlier.

Week 4 – Forecast and Adjust

- Build a 13-week forecast in Fathom, Jirav, or LivePlan.

- Run three versions: base, low-sales, and high-sales.

- If you hold inventory, set reorder points in Cin7 or Katana and review turnover weekly.

Guard Against Risk

Cash flow tools make movement easier, but that also attracts risk.

- Enable multi-factor authentication on all platforms.

- Choose tools with fraud protection baked in, especially for payment processing.

- Benchmark your Days Sales Outstanding (DSO) and Days Payable Outstanding (DPO) monthly.

- Model funding programs (like Shopify Capital) carefully. Fast money can be expensive.

Tool Shortlist by Cash Need

| Need | Recommended Tools |

| Faster collections | Stripe Billing, GoCardless, Chaser |

| Payables control | BILL, Melio |

| Spend discipline | Ramp, Brex, Pleo |

| Forecasting & scenarios | Fathom, Jirav, LivePlan |

| Inventory visibility | Cin7, Katana |

| Cross-border payments | Wise Business |

FAQs

Bottom Line

Cash management isn’t about stacking twenty different tools. You need a lean setup that makes cash timing visible and controllable:

- Accounting system with real-time cash insights.

- Invoicing tool that collects quickly.

- AP system that pays on due dates, not before.

- Expense platform that enforces discipline.

- Inventory software if your money sits on shelves.

- A 13-week forecast that updates every week.

Small companies that run this setup consistently spend less time panicking over liquidity and more time building margin. Cash stops slipping through unnoticed gaps, and stays available when you actually need it.

Hey there! I’m Isla Craig. I’ve spent years diving into the ins and outs of the modern workplace, helping people get ahead and feel good about their careers. From boosting productivity to nailing leadership skills and personal growth, I’ve got a bit of experience in it all.

On our website, my mission is simple: give you the tools and tips you need to rock your career and enjoy a balanced life. I’m here to be your go-to source for advice and inspiration, no matter where you are in your professional journey.